Find A Lawyer Near You

Looking for a lawyer to guide you with legal matters? Let us connect you with experienced attorneys near you who can protect your rights and provide trusted legal guidance.

Find Lawyers Near You

Enter your zip code and select a service type to get started

Find expert lawyers from around the world

Looking for experienced legal experts to guide you through litigation, contracts, and regulatory compliance? Let us connect you with the perfect attorney from our pool of licensed legal professionals.

- Search for your area zipcode and service you need

- Get a list of lawyers near you

- Connect and collaborate

Stay compliant with expert legal advice

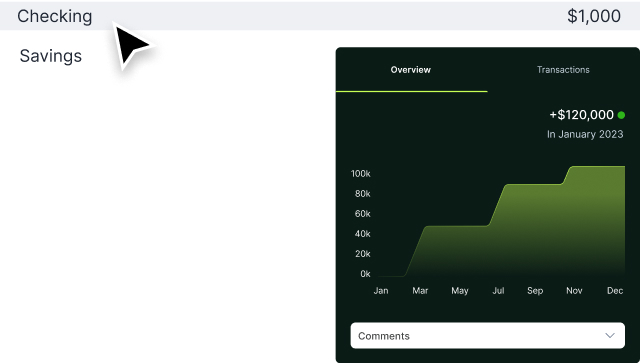

Prepare your financial records with precision and confidence, guided by our network of skilled business lawyers and tax advisors. We connect you with lawyers who specialize in aligning your records with legal requirements, offering tailored strategies to meet your unique financial needs and business objectives.

Get consultation from expert lawyers on

- Legal planning and strategy

- Contract drafting and review

- Business formation and structure

- Intellectual property protection

- Employee laws

- Dispute resolution and litigation

- Regulatory compliance

- Corporate Governance

- Lease agreements and zoning compliance

- Data privacy and security laws

Why choose professional legal consultation

Gain precise guidance from seasoned experts tailored to your needs. Get advice on contracts, compliance, and smart legal decisions aligned with your goals.

Stay compliant with evolving laws using adept business lawyers. Navigate regulations, minimize risks, and uphold your reliable reputation.

Boost workflows with business lawyers' expertise. Identify bottlenecks, enhance contracts, and elevate operational efficiency.

Rely on advisors for grounded choices. Benefit from analysis for growth and profitability.

Get all-round solutions from legal and financial experts. Tackle challenges, seize opportunities, and triumph in business.

Work with pros for custom approaches. From partnerships to expansion, get guidance that fits

Frequently Asked Questions

What legal structure suits my business, and what are the tax implications?

The appropriate legal structure depends on your business goals. Common options include: Sole Proprietorship: Simplest form, but you're personally liable. Partnership: Shared responsibilities and liability among partners. Corporation: Offers liability protection but involves more formalities. Limited Liability Company (LLC): Blends liability protection with flexibility. S Corporation: Combines liability protection with pass-through taxation.

How can I legally optimize my business for tax benefits?

Legal strategies to optimize taxes include: Structuring employee benefits and retirement plans. Utilizing available tax credits, such as Research & Development. Identifying deductions like Section 179 for equipment expenses. Ensuring compliance with Qualified Business Income (QBI) deduction.

What legal agreements do I need to safeguard my business interests?

Essential agreements include: Contracts for clients, suppliers, and partners. Operating Agreements (for LLCs) or Bylaws (for corporations). Non-disclosure agreements (NDAs) to protect sensitive information. Employment agreements, detailing terms and expectations.

How can I navigate legal challenges while expanding internationally?

International expansion involves legal complexities: Comply with foreign business regulations and tax laws. Address intellectual property protection across borders. Establish contracts that account for international jurisdictions.

What steps can I take to protect my business from legal disputes?

Mitigate legal risks by: Clearly defining roles and responsibilities in partnership agreements. Including arbitration or mediation clauses in contracts. Ensuring compliance with industry-specific regulations. Safeguarding intellectual property with patents, trademarks, or copyrights.

How do I handle tax audits or legal actions against my business?

In the event of audits or legal actions: Keep meticulous financial records to substantiate your position. Consult with legal experts during the process. Respond promptly and professionally to inquiries. Explore settlement options if applicable, guided by legal counsel.

What are the tax implications of buying or selling a business?

Considerations when buying or selling a business: Asset versus stock purchases, each with distinct tax treatments. Valuation methods affecting capital gains and losses. Structuring deals to maximize tax efficiency. Drafting thorough purchase agreements to address tax-related clauses.

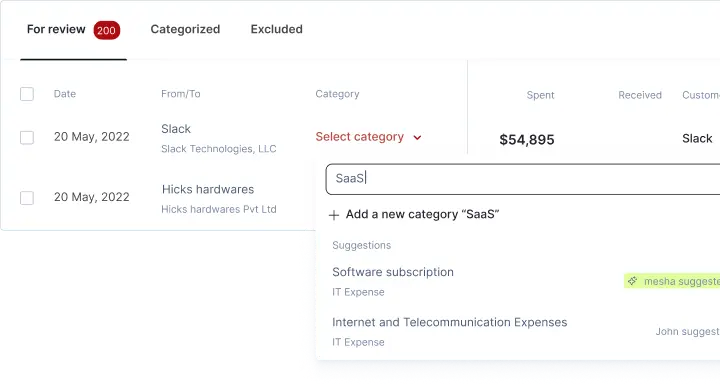

Get registered as a legal expert with mesha

List your legal services on mesha and let potential clients find and contact you. Connect with us to get added to the mesha directory.